Considering how different the screen sizes are for computers—most of which have a screen resolution of 1024x768—and mobile phones—whose screens are tiny, with even smartphones often having a screen resolution of only 320x480—as well as their very different contexts of use, how can we optimize payment methods for mobile devices?

Issues with Real-World Payment Methods on Mobile Devices

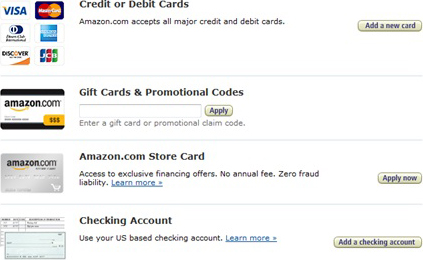

There are several issues with using real-world payment methods on mobile devices. First, it’s a pain. While it might not be too difficult to type in a credit-card number on a smartphone if you remember the number, when you need to hold both your phone and your credit card, it becomes a challenge.

Another issue relates to security and privacy. It’s one thing to type your credit-card number into a check-out form when you’re sitting in the privacy of your own home. It’s quite another thing when you’re sitting in a busy coffee shop, using your smartphone to purchase a deal that you just saw on Groupon. In public, holding your credit card while you type its number is definitely not one of the safest things to do.

Finally, some people are not credit-card holders. Teenagers who don’t have credit cards or debit cards comprise a large proportion of mobile users. As the ABI research points out, teenagers are the primary consumers of virtual goods for video games, so they need some means of purchasing them. The larger population from countries outside the US, where credit cards are not as popular, encounter the same issue.

Issues with Virtual Online Payment Methods on Mobile Devices

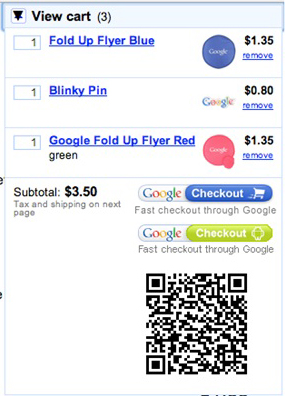

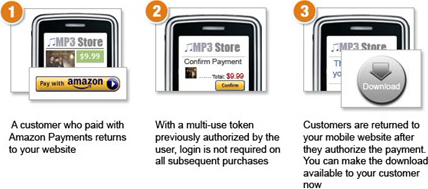

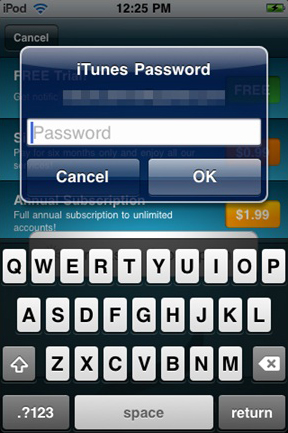

Virtual payments seem to be a better solution for mobile devices, because they eliminate the necessity of having any type of credit or debit card. PayPal’s mobile payments have increased from $25 million in 2008 to $141 million in 2009 and are continuing to grow. Google Checkout recently released a Chrome browser extension, Google Checkout Android Payment, shown in Figure 3, that lets Android users make payments on their smartphones. Since the mobile-payments market is so attractive, two more ecommerce giants are trying to get into the game. With its payment system that lets people use one button to check out, shown in Figure 4, Amazon is trying to take advantage of its large user base. As Figure 5 shows, Apple is trying to leverage the momentum of their success with their iTunes store and the popularity of the iPhone in the US.

Besides the obvious advantages of not needing to have a credit or debit card or enter a card number, virtual payment methods also allow people who aren’t card holders, such as teenagers, to be able to pay for goods on their phone. For example, teenagers might have a virtual-payment account that their parents have set up, with parent-imposed spending limits.

Credit-card companies offer several types of account protection, as well as fraud-control features. Virtual-payment services such as PayPal are continually evolving to meet user expectations and now offer improved features such as seller and buyer protection. But there are still safety issues.

However, the toughest challenge for virtual payments is cross-platform implementation and standardization. Google Checkout’s Chrome extension is available only to Android users who already have a Google Checkout account. PayPal requires both merchants and buyers to have a registered and verified PayPal account in order to make transactions. So, what would be the best way to integrate payment methods with the current smartphone platforms? With a browser extension like Google Checkout, a soft button on an ecommerce site’s checkout page, or a physical button on a mobile device?